Created by: Fidelis Wealth Advisors

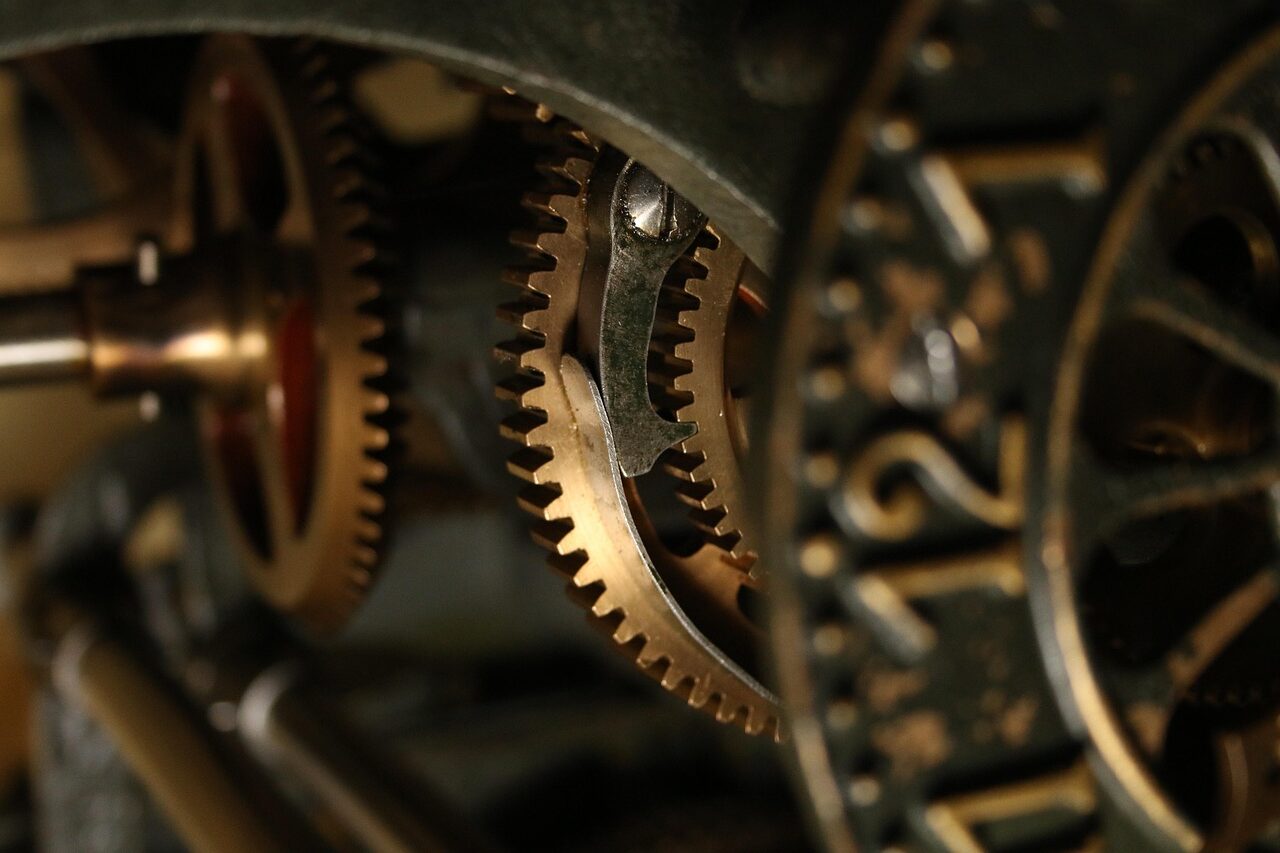

If managing your finances was a machine, then it might look a lot like the inside of an old-fashioned clock. Lots of gears turning in opposite directions, each one seemingly doing a different job and perhaps giving the appearance they are working toward opposite goals. Yet through the midst of all the twisting and turning, a properly constructed clock will accurately do its job; i.e., tell time – despite all the moving parts.

Saving, spending, investing, budgeting, and making good decisions with your money can sometimes feel like the inside of an old clock. Your money is always being pulled in a variety of directions. Save for the future! Spend today and enjoy the moment! Invest in your kid’s education! Buy a new car! Buy this, spend that, save this, invest in that!

In our August 2022 Newsletter, titled, “A Bucket Approach for Your Money”, we discussed a framework of how to organize your money into ‘buckets.’ The idea behind this framework is to make sure each dollar you have is properly doing its job, whatever it might be. For example, you might be saving for a variety of goals at the same time, such as retirement, kid’s education, a family vacation, or a new car. Similar to our clock analogy, all of these goals may feel like gears pulling your money in different directions. When lots of money goals seem to be bumping into each other, the key is to take a step back and make sure your money buckets are properly organized.

The goal with any clock is to make sure the time is accurate. Likewise, the goal with any money decision is to make sure the gears are all working together in the most efficient way; be that efficiency with taxes, income, growth, etc. In the realm of your money, if you have ever had the thought, “What should I do?”, let us help you organize your money and get all of the gears working together.

Please note by using any of the links provided for your convenience, you will be leaving Fidelis Wealth Advisors website. The hyperlinks are to websites and servers maintained by third parties. We do not control, evaluate, endorse, or guarantee content found in those sites. Your use of such sites is at your own risk.

This blog is general communication being provided for informational purposes only. This information is in no way a solicitation or offer to sell securities or investment advisory services. It is educational in nature and not to be taken as advice or a recommendation for any specific investment product or investment strategy. This does not contain sufficient information to support an investment decision. Any investment or investment strategy mentioned may not be suitable for all investors or in their best interest. Statistical information, quotes, charts, references to articles or any other quoted statement or statements regarding market or other financial information is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. All rights are reserved. No part of this blog including text, graphics, et al, may be reproduced or copied in any format, electronic, print, et al, without written consent from Fidelis Wealth Advisors, LLC. Fidelis Wealth Advisors does not provide legal or tax advice. Please be advised to consult with your investment advisor, attorney or tax professional before making any investment decisions.