Created by: Sam Tenney

- The Federal Reserve “financial stability” biannual report for 2021 outlines markets as likely overvalued compared to cash flows, and notes a huge increase in housing prices since earlier in the year however does not see any excessive leverage in the housing sector. The market remains vulnerable to significant declines if investor sentiment deteriorates, the Fed has noted.

- The 10-year breakeven rate, the rate of 10-year inflation protected bonds minus the 10-year constant treasury bond, has risen to a decade high, with the spread between these two assets reaching 2.73%. This signals intense predictions by the market for the rate of inflation over the next decade.

- JP Morgan believes the disconnect between the Fed beginning to taper, and the continued surge in Core Product Inflation (CPI), shows that not all inflation we are seeing may be transitory. This is compared to the Federal Reserve’s stance that current inflation is being caused by the continued reopening of world economies after Covid, and not necessarily due to the large amounts of stimulus injected into the economy.

SOURCES

- https://www.federalreserve.gov/publications/files/financial-stability-report-20211108.pdf

- https://www.ft.com/content/59d0b03a-f716-4c7a-9bf5-b5c87082cbdd

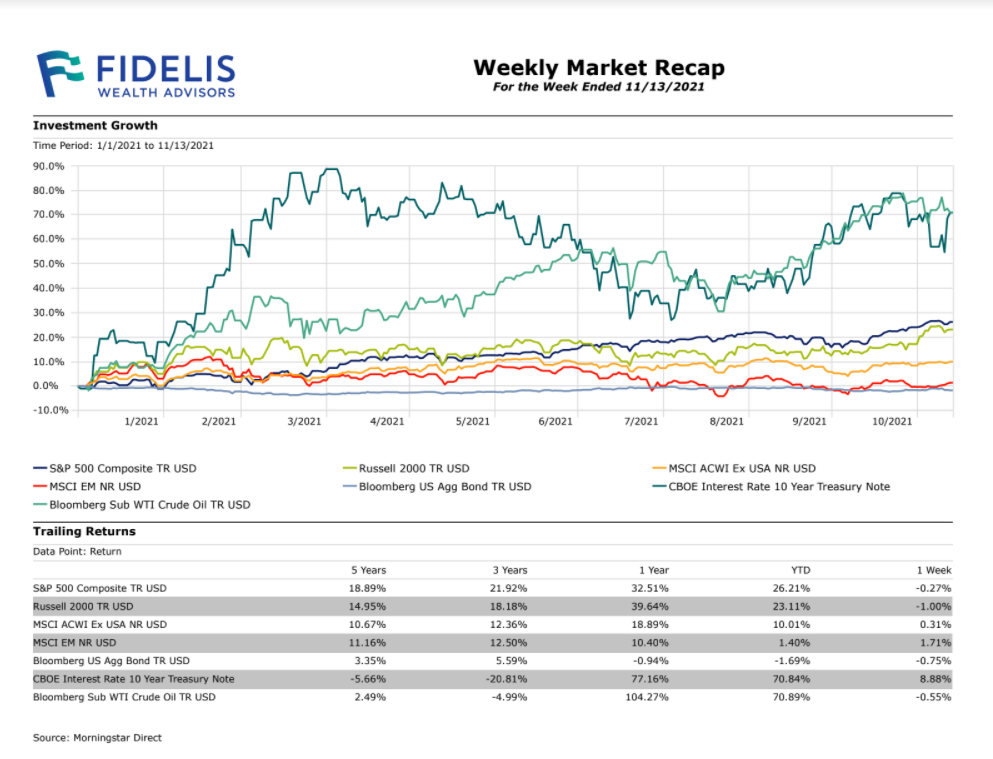

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/weekly-market-recap/

Please note by using any of the links provided for your convenience, you will be leaving Fidelis Wealth Advisors website. The hyperlinks are to websites and servers maintained by third parties. We do not control, evaluate, endorse, or guarantee content found in those sites. Your use of such sites is at your own risk.

This blog is general communication being provided for informational purposes only. This information is in no way a solicitation or offer to sell securities or investment advisory services. It is educational in nature and not to be taken as advice or a recommendation for any specific investment product or investment strategy. This does not contain sufficient information to support an investment decision. Any investment or investment strategy mentioned may not be suitable for all investors or in their best interest. Statistical information, quotes, charts, references to articles or any other quoted statement or statements regarding market or other financial information is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. All rights are reserved. No part of this blog including text, graphics, et al, may be reproduced or copied in any format, electronic, print, et al, without written consent from Fidelis Wealth Advisors, LLC. Fidelis Wealth Advisors does not provide legal or tax advice. Please be advised to consult with your investment advisor, attorney or tax professional before making any investment decisions.