Fidelis partners with The Aspen Effect to invest in Denver youth’s future.

Created by: Fidelis Wealth Advisors

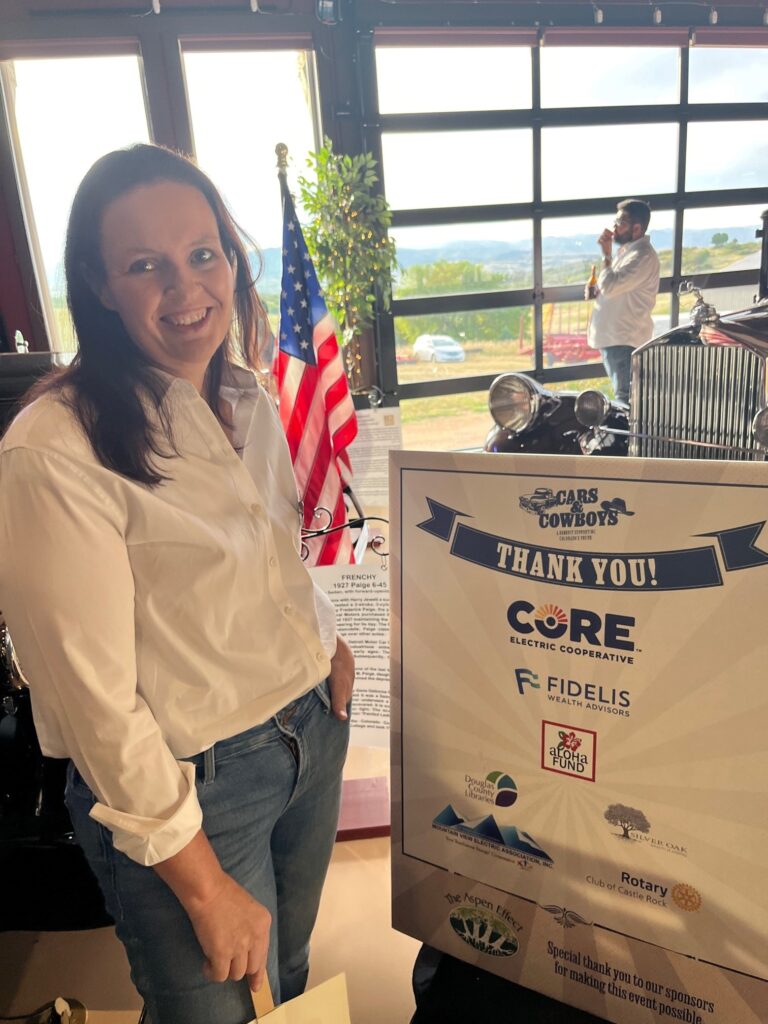

On September 9th, Fidelis Wealth Advisers had the privilege of standing alongside The Aspen Effect as a proud sponsor of their Cars & Cowboys Fundraiser. Not only did Fidelis support the event financially, but we also actively participated as attendees, immersing ourselves in the event to raise funds in support of Colorado’s youth.

Fidelis has pledged to sponsor a new program at the Aspen Effect for the next two years. The Teen Service Crew (TSC) will provide high schoolers with the unique monthly opportunity to earn required volunteer service hours, and to connect with different Douglas County organizations, and to learn life skills (including personal finance education provided by Fidelis). This opportunity will offer teenagers a pre-planned experience that will include service, leadership, learning and lunch.

The Aspen Effect, with its heartfelt mission, supports children in Colorado as the mental illness crisis grows. In a world where youth face mounting expectations, increasing social disconnection, and growing confusion, The Aspen Effect disrupts the crisis through a distinctive approach involving hard work outside with large animals. By forging partnerships with parents and guardians, this remarkable nonprofit organization seeks to empower children to reimagine themselves in positive ways, thanks to the presence of a caring adult mentor, captivating animal experiences, and a strength-centered approach.

The Cars & Cowboys Fundraiser event was nothing short of spectacular. Set against the backdrop of a full-scale replica of a 1950s gas station and diner, it exuded an authentic vintage charm. Attendees were also treated to the elegance of a beautifully restored barn, which served as the venue for the dinner and auction. As if that weren’t enough, an extraordinary collection of vintage cars added a touch of nostalgia and class to the event.

We at Fidelis couldn’t be prouder to align ourselves with The Aspen Effect’s cause. Relating the strength of the Aspen tree to the hidden strength each child processes, the organization empowers children every day. We believe in the power of supporting our youth, especially those facing mental health challenges, and we look forward to continuing to invest in Colorado’s youth. With such partnerships, we can make a lasting impact and provide hope and resilience to the children who need it most.

Please note by using any of the links provided for your convenience, you will be leaving Fidelis Wealth Advisors website. The hyperlinks are to websites and servers maintained by third parties. We do not control, evaluate, endorse, or guarantee content found in those sites. Your use of such sites is at your own risk.

This blog is general communication being provided for informational purposes only. This information is in no way a solicitation or offer to sell securities or investment advisory services. It is educational in nature and not to be taken as advice or a recommendation for any specific investment product or investment strategy. This does not contain sufficient information to support an investment decision. Any investment or investment strategy mentioned may not be suitable for all investors or in their best interest. Statistical information, quotes, charts, references to articles or any other quoted statement or statements regarding market or other financial information is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. All rights are reserved. No part of this blog including text, graphics, et al, may be reproduced or copied in any format, electronic, print, et al, without written consent from Fidelis Wealth Advisors, LLC. Fidelis Wealth Advisors does not provide legal or tax advice. Please be advised to consult with your investment advisor, attorney or tax professional before making any investment decisions.