By: Jeff Bullock

Over the past 40+ years, we’ve seen many news headlines that would make you want to run for the hills with your investment portfolio. Almost like standing at a fork in the road, being an investor can feel like you’re always deciding between investing or waiting. Here are a few actual headlines we’ve seen the past few decades:

Worst Year for Jobs since 1945

Wall Street’s blackest hours

Stock Market Crash

Where is the Economy Headed?

Fears Trigger Panic Selling

There always seems to be a reason not to invest your money. Wars, supply chain issues, inflation, sovereign debt problems, housing crises, lockdowns, terror, interest rate hikes, recession, etc. Pick the worst headline of the year, in any year, and you would think that the world might be coming to an end.

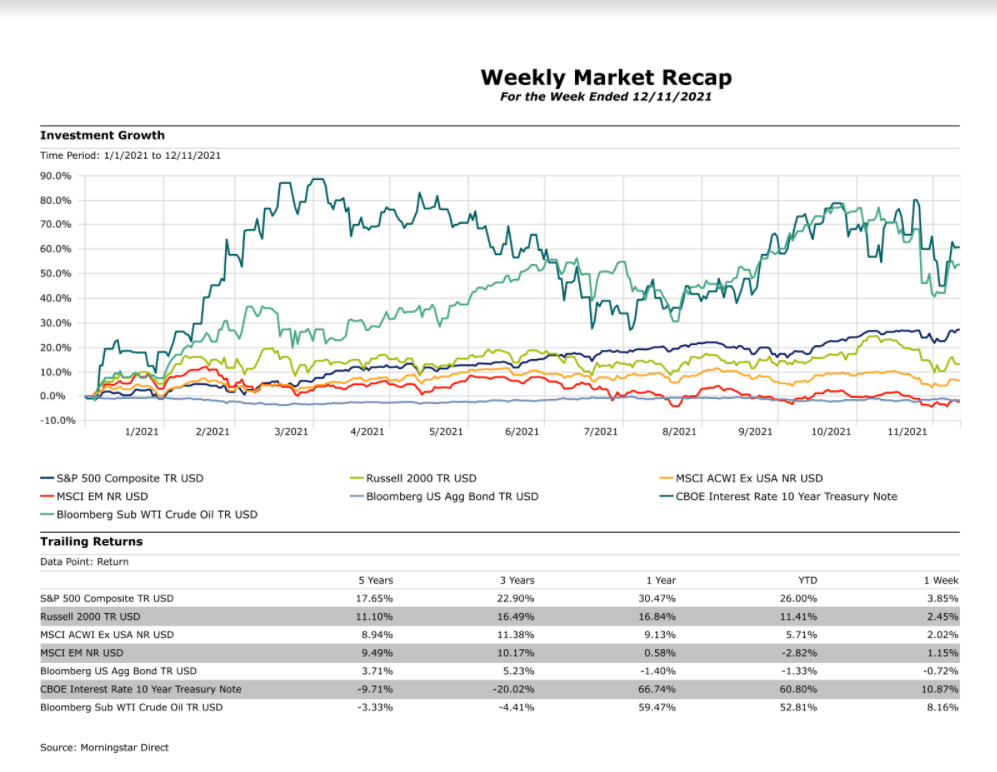

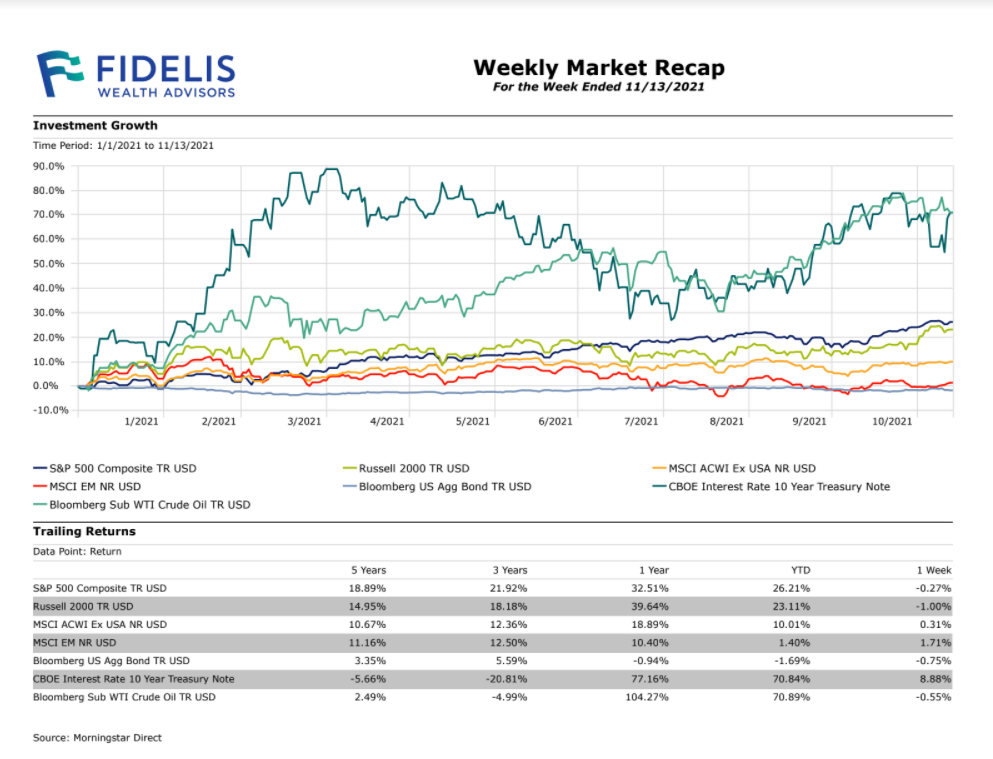

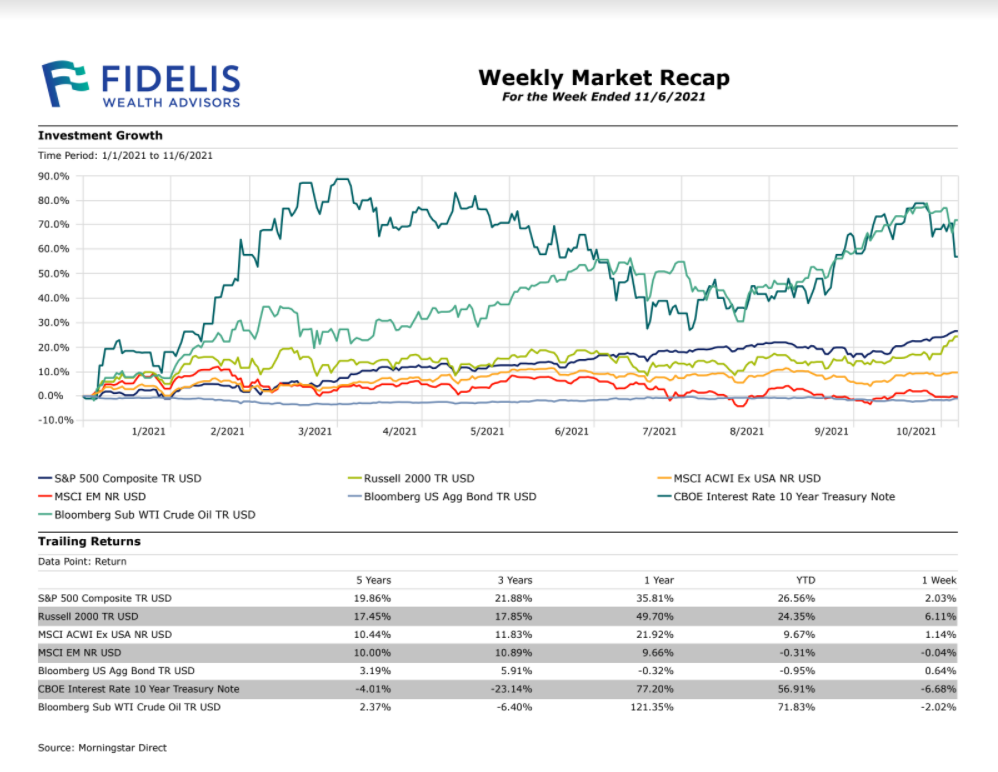

Despite all the negative headlines that filter through the news cycle, markets and the economy have not only shown resilience, but have proven to be a worthwhile place for wealth creation. This doesn’t mean recessions don’t hurt or slowdowns don’t occur from time to time, but over the long run, economic growth has taken a victory lap over the negative nay-sayers of the world. Markets sometimes overheat and then correct, while other times over-correct and then expand. This is the pattern markets have taken for decades and decades.

With an understanding of this pattern and the proper time commitment, the stock market has proven to be way to participate in economic growth. Markets will always be volatile, remember, this is a feature, not a bug. The key is staying disciplined and investing in a way that allows you to still sleep at night, even during the inevitable pullbacks. Over the last 40 years, the stock market has averaged at least one 14% pullback every year; yet despite this pullback, it has been finished the year positive 75% of the time. Ironically enough, as of the writing of this piece, the stock market is down 13.5% this year. Right on schedule.

There will always be reasons not to invest, and some of them are legitimate, but don’t let the bad headlines scare you away from your long-term goals.

This blog is general communication being provided for informational purposes only. This information is in no way a solicitation or offer to sell securities or investment advisory services. It is educational in nature and not to be taken as advice or a recommendation for any specific investment product or investment strategy. This does not contain sufficient information to support an investment decision. Any investment or investment strategy mentioned may not be suitable for all investors or in their best interest. Statistical information, quotes, charts, references to articles or any other quoted statement or statements regarding market or other financial information is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. All rights are reserved. No part of this blog including text, graphics, et al, may be reproduced or copied in any format, electronic, print, et al, without written consent from Fidelis Wealth Advisors, LLC. Fidelis Wealth Advisors does not provide legal or tax advice. Please be advised to consult with your investment advisor, attorney or tax professional before making any investment decisions.