By: Jeff Bullock

Money & Investing: Is Today Yesterday?

A while back my five-year-old daughter was in the kitchen eating her breakfast. She looked out the window, and then looked at me, and asked, “Is today yesterday?” What a great question! In a split second my mind raced to figure out how to answer her; I finally looked up and said, “Yes, today is yesterday!”

When it comes to investing money, as with many things in life, today often feels like yesterday, and tomorrow will probably feel like today. It can be easy to get caught up in the day-to-day fluctuations of financial markets and miss the big picture as to why we invest. Here are a few big picture principles that will hopefully make your tomorrow a better today:

- Market Cycles Are Real:

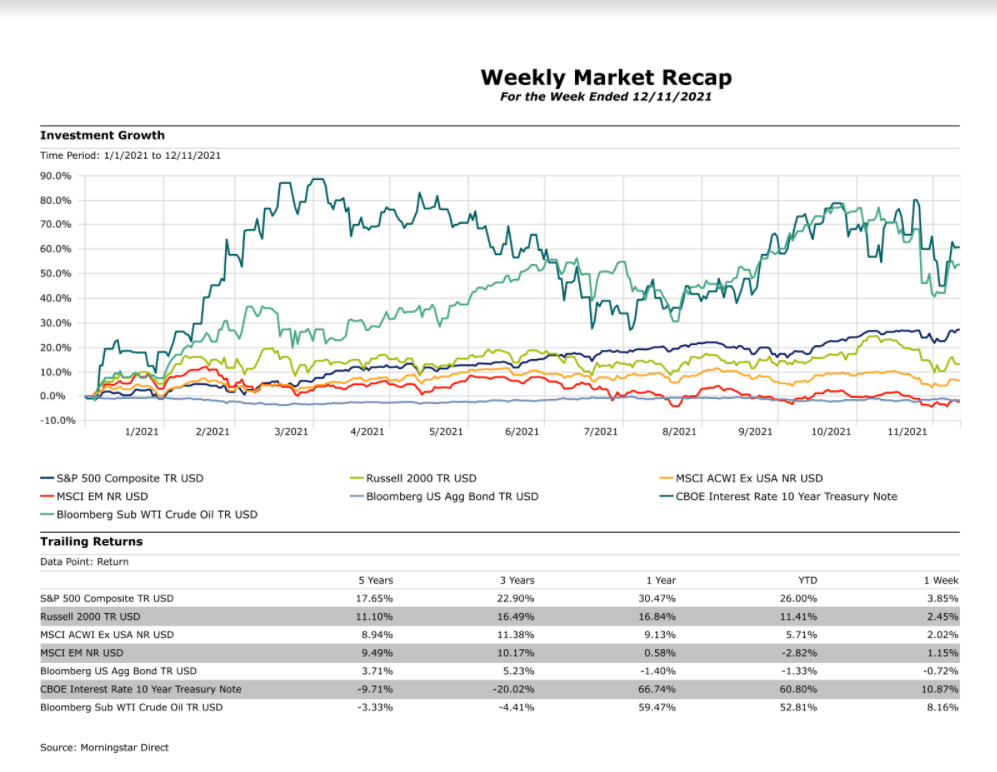

- Markets react to economic cycles, meaning there will be up years and down years. Understanding these cycles can help you weather the down years, knowing that long-term investing has historically been a good way to build wealth.

- Income – An Important Piece To Most Portfolios:

- I am a big proponent of income-generating investments such as dividend stocks and other alternative income strategies. Some of these investments pay income monthly, which can help mitigate the overall fluctuations of your account. Also, in times when markets bounce around for extended periods, these types of investments allow you to generate a tangible return month-to-month.

- Organize Your Money Into Buckets:

- In last month’s newsletter, I wrote about how to better organize your money by using the ‘bucket approach’. While day-to-day fluctuations can sometimes feel like a roller coaster, money that is properly organized maximizes the chances of good decision-making.

While my daughter’s question is a bit of a play on words, there are sound principles we can take from the simple question. Is today yesterday? Most likely, ‘Yes’, but your path for a better tomorrow starts by taking a big picture approach to investing so that your future tomorrows are better than yesterday!

This blog is general communication being provided for informational purposes only. This information is in no way a solicitation or offer to sell securities or investment advisory services. It is educational in nature and not to be taken as advice or a recommendation for any specific investment product or investment strategy. This does not contain sufficient information to support an investment decision. Any investment or investment strategy mentioned may not be suitable for all investors or in their best interest. Statistical information, quotes, charts, references to articles or any other quoted statement or statements regarding market or other financial information is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. All rights are reserved. No part of this blog including text, graphics, et al, may be reproduced or copied in any format, electronic, print, et al, without written consent from Fidelis Wealth Advisors, LLC. Fidelis Wealth Advisors does not provide legal or tax advice. Please be advised to consult with your investment advisor, attorney or tax professional before making any investment decisions.