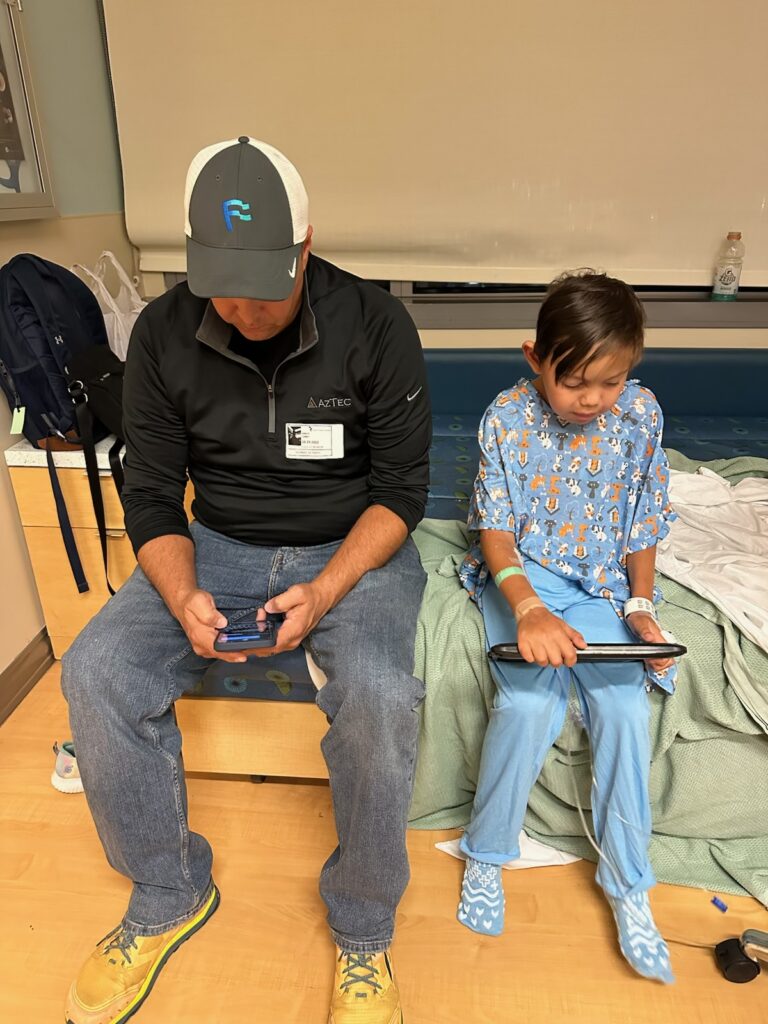

Fidelis Family Highlight: An Update from Sam regarding Paul 🌟

I wanted to share some thoughts about our journey with my son (stepson) Paul.

Jamie and Paul came into my life just over 3 years ago. Paul has had a lifetime full of health problems, including being born without a functioning kidney. He was able to get his first kidney transplant when he was 2.5 years old. Just under four years ago, his transplanted kidney stopped working. Paul started dialysis 3 days a week and Jamie began the process of getting Paul listed again on the kidney transplant registry (which is NOT a quick or easy process).

Due to Paul’s prior kidney transplant, blood type (B), and history of health issues, we were advised that they are looking for a “needle in the haystack” for a matching kidney. The reason why; Paul had a 99% antibody rejection rate, almost any donated kidney his body would reject. Hence, “needle in the haystack”. Colorado Children’s Hospital had a similar child that it took almost 10 years to find a suitable match.

Jamie and our family have been praying for a miracle for years now. I noticed Jamie’s prayers changed in the last year, she had asked God to help us find the “Perfect” kidney for Paul…not just a kidney.

After almost four years of dialysis (approximately 600 dialysis treatments or 2,400 hours on the dialysis machine) and three years listed at Colorado Children’s Hospital, we got the miraculous call that they found a kidney for Paul. As Jamie, Paul, and I spoke with the transplant coordinator while sitting on a jet ski at Lake Powell, we heard that they found the “perfect” kidney for Paul, A Perfect Match, no desensitization or magical medical gymnastics to “make it work”. I lost it, I knew God had answered our prayers, Jamie’s specific prayers!

Four years ago, next month, we lost my 20-year-old nephew Taj Cornum in a car accident. While he was brain dead in a Colorado Springs hospital, his family made the decision to donate his organs. I watched as the transplant coordinator, nurses, and doctors, kept Taj alive to allow for him to live on in others and sustain life for those in need. I experienced the “Honor Walk” as Taj was wheeled from ICU to the ambulance taking him away. The heartache for all involved was extreme. I know the family was so grateful he was able to live on by helping others…

My heart aches for the family that just experienced this tragedy so that Paul could have his miracle, perfect kidney. Thank God for the family that was willing to share their loved one with Paul. Thank God for Burke & Nicky Cornum that they were willing to share Taj four years ago. Thank you to all that have supported Jamie, Paul, and our family through our journey.

Isaiah 55:8-9:

“For my thoughts are not your thoughts, neither are your ways my ways, saith the LORD. For as the heavens are higher than the earth, so are my ways higher than your ways, and my thoughts than your thoughts.“